Your financial footprint

Do you know what industries your money is being invested into? What if you knew your money was funding unsustainable and harmful industries like fossil fuels, tobacco or weaponry? Investing your money into sustainable pensions with positive impacts can help save the planet whilst growing your pension fund.

Green your pension

Research done by Make My Money Matter, Aviva and Route2 has revealed that investing into sustainable pensions is 21x more powerful than becoming vegetarian, giving up flying or switching to renewable energy.

Why it works

It’s widely believed that the Governance part of the ESG approach leads to better returns in the long run. This is because you’re investing into companies that have better management and corporate structures in place than their counterparts. In recent times, many ESG and sustainable funds outperformed their non-ESG peers.

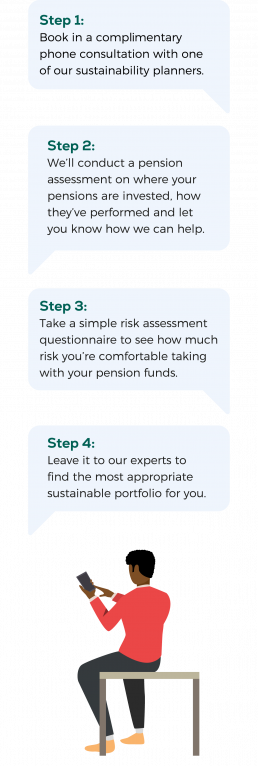

How it works

The advice we offer is restricted to our own ethical, ESG and sustainable range of funds. This means we can only recommend these products in line with your financial objectives and personal values.

The advice we offer is restricted to our own ethical, ESG and sustainable range of funds. This means we can only recommend these products in line with your financial objectives and personal values.

What we invest in

We review a broad range of global funds that invest in companies which meet environmental, social and governance (ESG) criteria. Our portfolios have a targeted weighting towards positive impact which includes companies that can demonstrate measurable benefits to the world.

Sustainable decarbonisation

Climate change mitigation

Positive impacts on society and the environment

Supporting companies transitioning to sustainability

Driving positive change through engagement

Companies we invest in...

Click the logos to find out more about these companies and the funds that they are part of

How we measure impact

The area of sustainable and ESG investing is very wide and can encompass many different areas. The United Nations Sustainable Development Goals provides a useful framework for fund managers to demonstrate which areas their investment portfolios focus on.

Another way we can determine how investing in these firms can help do good is by way of active engagement where shareholders can influence the management of the company. A fund manager is uniquely placed to make their own impact upon the company given they can often have a sizeable stake in the company.

The UN Sustainable Development Goals:

Fees

We’re proud to offer competitive fees and a transparent charging structure.

Before you commit, we offer a free, initial phone consultation to help us get to understand you better and to see how we can help.

Fees will be paid directly from your pension fund unless otherwise agreed.

About you

- You have pension funds of at least £25,000 which could be split across several providers.

- You are at least 5 years away from your chosen retirement age.

- You are a UK resident for tax purposes and intend to remain living in the UK.

- You are aware that this service does not provide advice on life assurance or income protection, which most investors should consider before investing.

A bit about us

TSPC has been born at a time of great positive ESG momentum: we are all too aware of the harsh realities of climate change. TSPC has also been inspired by the Make My Money Matter campaign which calls on people to ‘green their pensions’.

We are a small team but with support from our sister company, Aspirations Financial Planning, we’re big enough to give you the attention you need. From each of our carefully selected funds to the way we’ve built our green website, sustainability is at the heart of everything we do. Our aim is to provide people with a pension they can be proud of. We do this by finding, vetting and creating sustainable portfolios with an impact tilt and conducting ongoing due diligence checks on each fund.